If you’re in the US, Europe, or other places that enjoy relatively frictionless payments, widespread digital banking, & readily available credit, it can be hard to appreciate the realities of financial services in emerging markets across Africa & elsewhere.

In Nigeria, for example, ~55% of adults don’t have bank accounts; in Egypt, cash accounts for almost 3/4ths of the national payment volume; and in sub-Saharan Africa as a whole, bank credit is generally hard to come by for all but the most prominent and most well-connected institutions and individuals.

While much can be said about financial inclusion and the digitization of payments, access to credit plays a key role in economic development and this article will focus on lending.

Success in lending depends on 3 Ds:

- data,

- distribution, and

- “dollars” (i.e., balance sheet access — preferably in local currency to guard against FX risks).

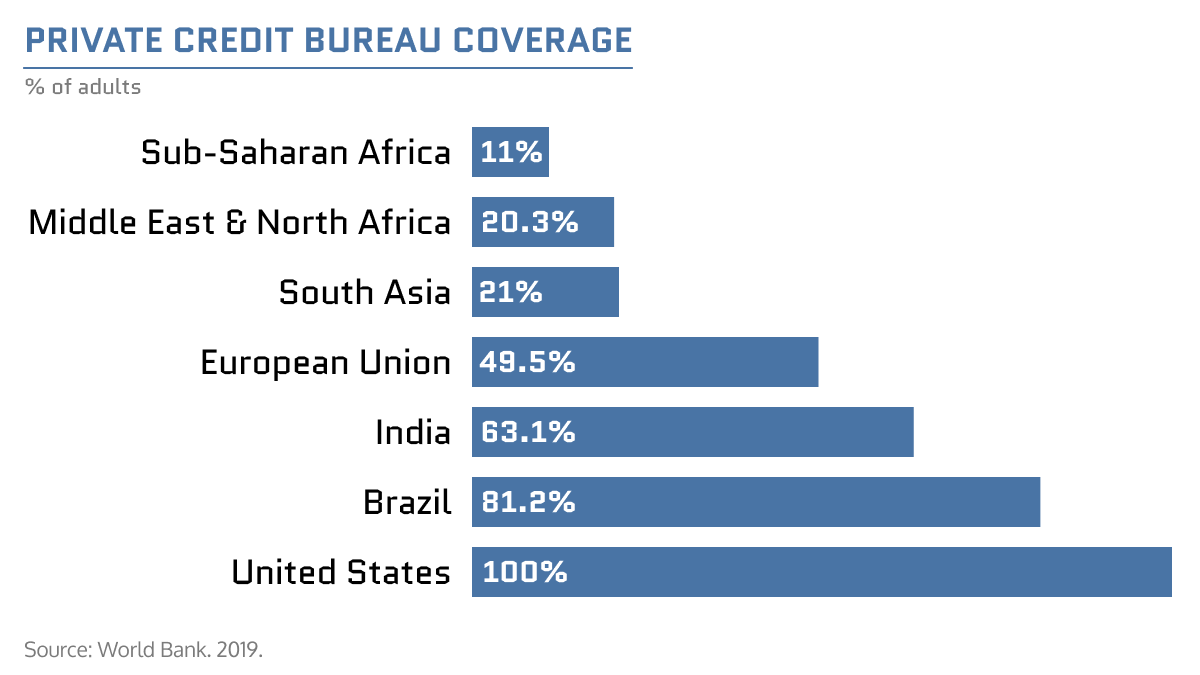

But with so many unbanked and underbanked people across the African continent, formal credit data largely doesn’t exist and centralized credit bureaus tend to be in their infancy.

Source: World Bank

That’s part of why risk-averse incumbent banks in Africa generally avoid SME/consumer lending despite their distribution advantages.

And while a variety of digital lenders have filled the void with ‘alternative’ credit models that sometimes rely on phone call logs, internet browsing history, messaging habits, daily location patterns, social media behavior, and the like to assess creditworthiness, they generally don’t have existing distribution and they rely, in many cases, on VC funding to acquire customers.

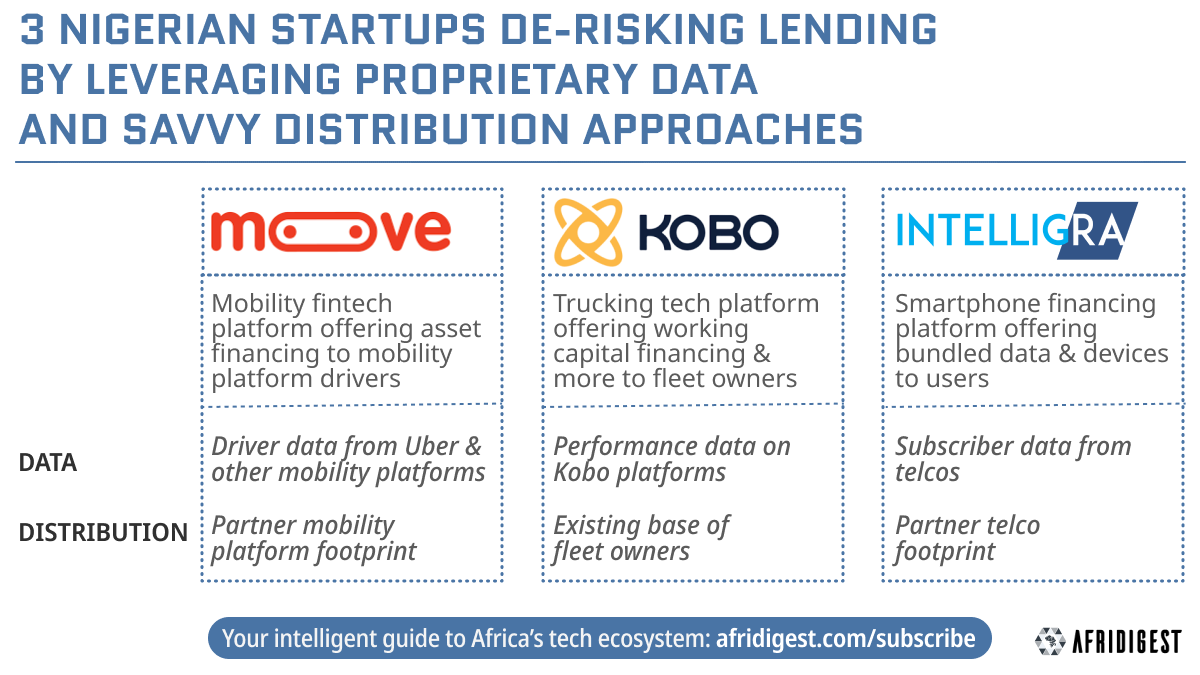

But a number of startups are attacking the space differently. They use unique and/or proprietary data to build smart credit models while enjoying in-built distribution that lowers customer acquisition costs.

Here’s a look at three Nigerian startups doing just that.

Lending to ride-hailing drivers: Moove

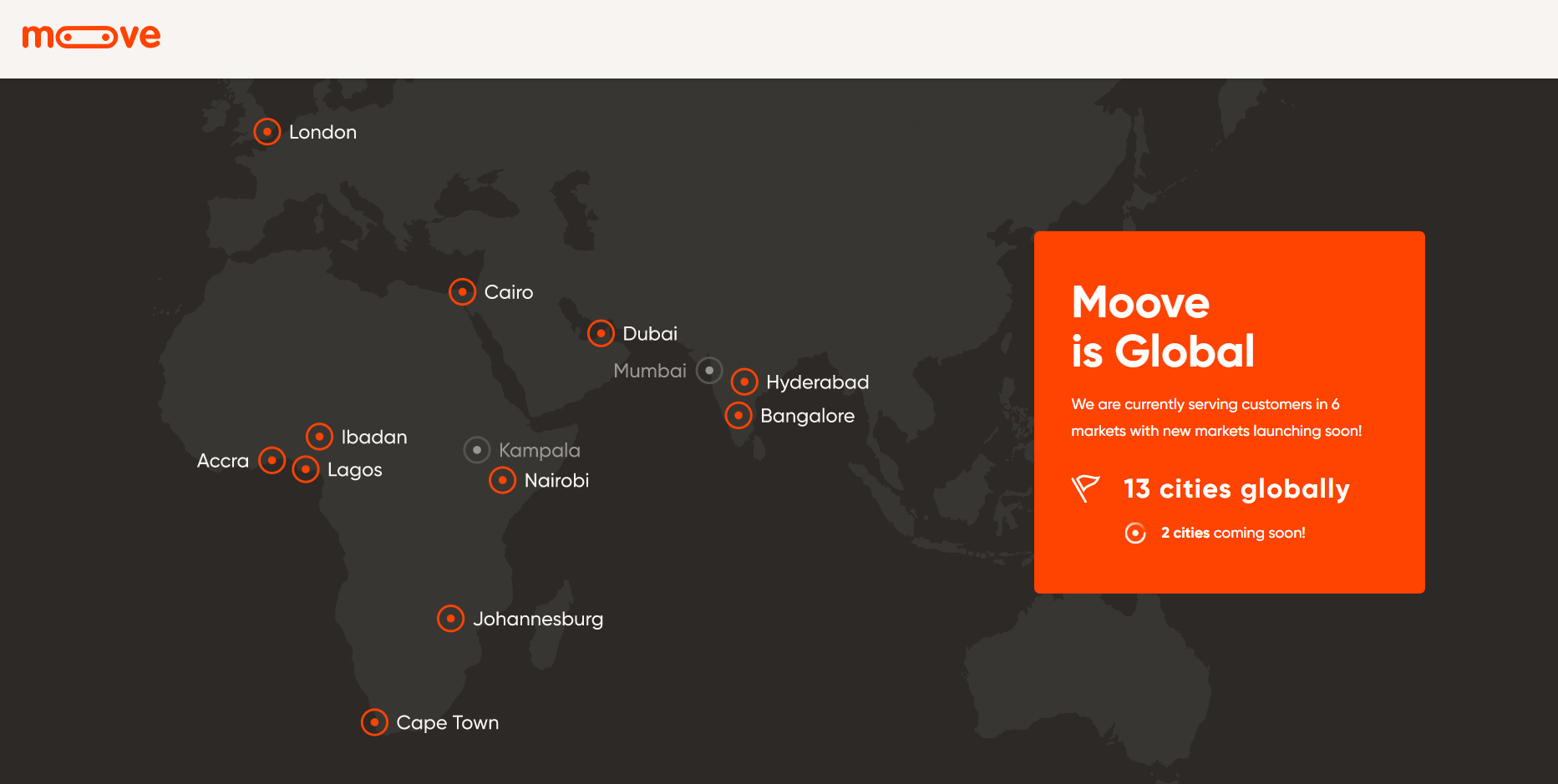

Founded in Nigeria in 2019, ‘mobility fintech’ Moove is “democratizing access to vehicle ownership” and now operates in thirteen cities across the world.

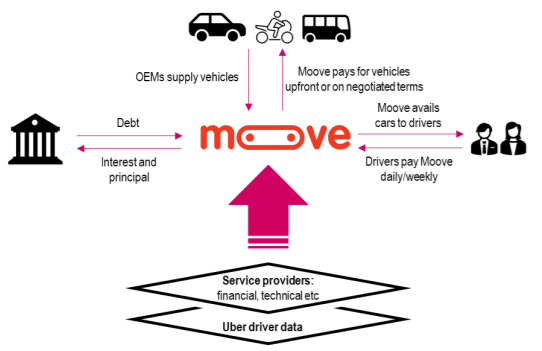

The company buys vehicles from car manufacturers and makes them available via flexible rental and lease-to-own models to mobility micro-entrepreneurs who drive for platforms such as Uber, Glovo, Careem, and Sendy.

Moove is Uber’s exclusive fleet manager, at least in sub-Saharan Africa (outside of South Africa), and ~90% of its business globally comes from Uber, the largest ride-hailing company in the world.

Under its agreements with Uber drivers, Moove is supposed to receive driver gross earnings from Uber directly, deduct amounts owed, then remit the remaining balance to drivers.

In reality, however, this only works as intended in markets like South Africa where card usage is high. In cash-dominant markets like Nigeria and Ghana, drivers have to initiate fee payments to Moove directly (since cash is collected by the drivers, not the platforms).

Source: Renaissance Capital

Nonetheless, thanks to its partnership with Uber, Moove has access to unique, proprietary data — driving hours, revenue, ratings, etc. — that it uses to develop smart, alternative credit scores.

At the same time, it leverages Uber’s existing driver base & driver acquisition efforts for distribution, resulting in minimal customer acquisition costs (CAC) and efficient worldwide scalability.

Lending to trucking fleet owners: Kobo

Officially founded in Nigeria in 2018 as an asset-light ‘Uber for trucks’ platform, Kobo360 connects large companies needing freight services with truck operators.

Today, the company works with over 50,000 truck owners across Nigeria, Togo, Ghana, Kenya, Uganda, and other African markets.

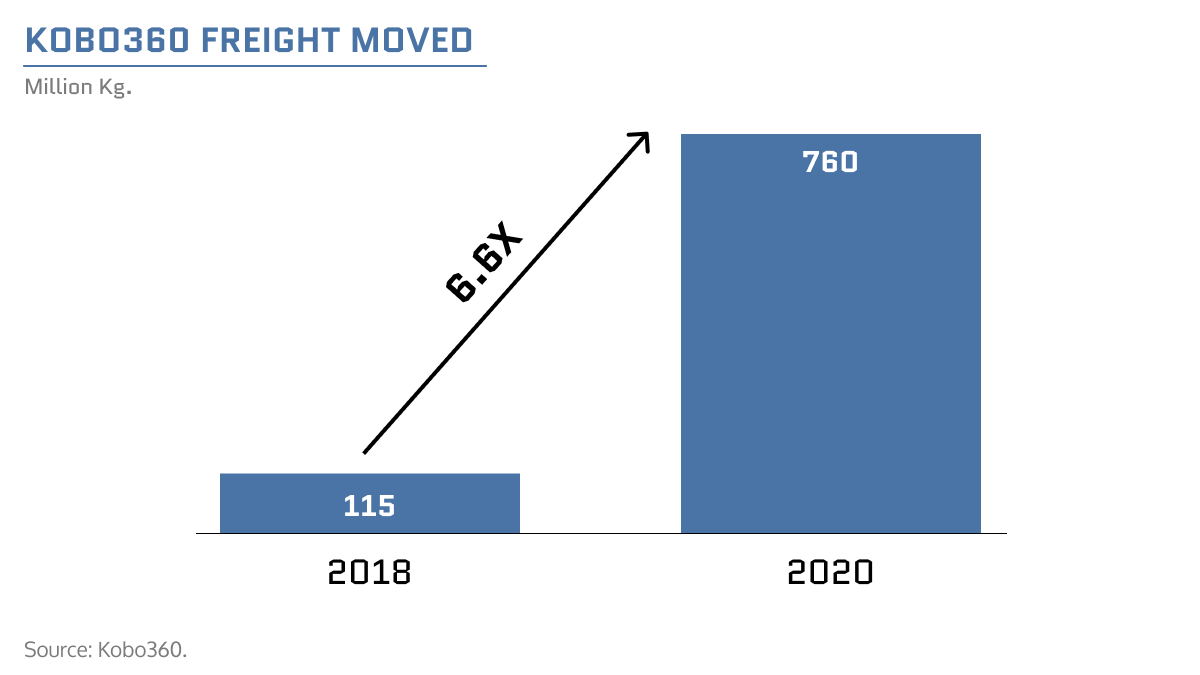

The company spent its early years focusing on building what it calls a ‘global logistics operating system’ — it aggregated ~5,500 truck drivers and served over 300 businesses in its first full year of operations — and today it counts among its clients some of the largest companies operating in Nigeria like Olam, Maersk, and Dangote.

But while many of its large multinational clients have contractual 30-day payment cycles, Kobo’s trucking fleet owners have to pay drivers’ wages, pay for fuel, and pay for maintenance more regularly.

So, Kobo started a pilot for Payfasta, an embedded finance product that offers trucking fleet owners credit based on their historical platform data, in 2019, and it fully launched the product in 2021.

The majority of Payfasta loans, roughly 70%, are for working capital needs, but another ~30% are for growth & investment needs like buying additional trucks.

And because working capital needs are largely de-risked as the service has already been delivered and is just awaiting payment, only ~0.08% of Kobo’s working capital loans are non-performing, according to the company’s founder, Obi Ozor. And just ~1.4% of its growth/investing loans are non-performing — a testament to the quality of its data-based alternative credit scoring approach.

Moreover, since the underlying Kobo platform serves not only as the base of data for Payfasta, but also as distribution, Kobo has been able to scale the offering quickly and with minimal to no additional CAC, deploying over $500M to trucking fleet owners over Payfasta’s lifetime.

Lending for smartphone purchases: Intelligra

Founded in 2020, Intelligra provides smartphone financing solutions to consumers in conjunction with OEMs, telcos, and banking partners.

So far, the company has entered into a non-exclusive partnership with MTN, Africa’s largest telco by revenue and subscriber base, and targets MTN Nigeria and MTN Rwanda subscribers.

In both markets, it uses mobile network operator data, subject to regulatory & privacy constraints, to develop smart, alternative credit scores.

And at the same time, it leverages MTN’s existing subscriber base & subscriber acquisition efforts for distribution, lowering its customer acquisition costs (CAC) and enabling it to more easily scale across MTN’s pan-African footprint.

Final thoughts

The appetite for credit is virtually unlimited across African markets, but data, distribution, and balance sheet access are the keys to lending success.

In an environment where formal credit data is largely unavailable, it’s worth studying models like, Moove, Kobo, and Intelligra that not only use unique, proprietary data to build smart credit models to lend intelligently, but also leverage savvy distribution strategies to reach customers efficiently.

Interested in actionable, expert insights to help you succeed? Africreate offers strategic intelligence as a service to leading startups, corporates, and investors across African markets. Say hello: hello@africreate.com

Share: